Venture Capital

Once you enter the startup scene, venture capital (VC) is probably one of the most frequently discussed subjects. In this article, we’ll go deep into the concept of venture capital and how it works.

What is Venture Capital?

Venture capital (VC) is a form of private equity and financing that investors provide to startups and early-stage companies with significant growth potential. Venture capitals are taking high risks with the expectation of high returns. In return for funding, VC firms usually take between 25 and 50% of a company's ownership stake. VC funds’ goal is to increase the startup's value and eventually profitably exit the investment. Although it’s a common way, venture capital does not always take a monetary form. It can be provided in the form of technical support or managerial expertise. In addition to this, portfolio companies can get access to the VC fund’s network of partners and experts or depend on the VC firm’s assistance when they raise more money in the future. These advantages make venture capital a popular, even essential source for emerging companies, especially those who lack access to capital markets, bank loans, or other debt instruments.

Private Equity vs. Venture Capital

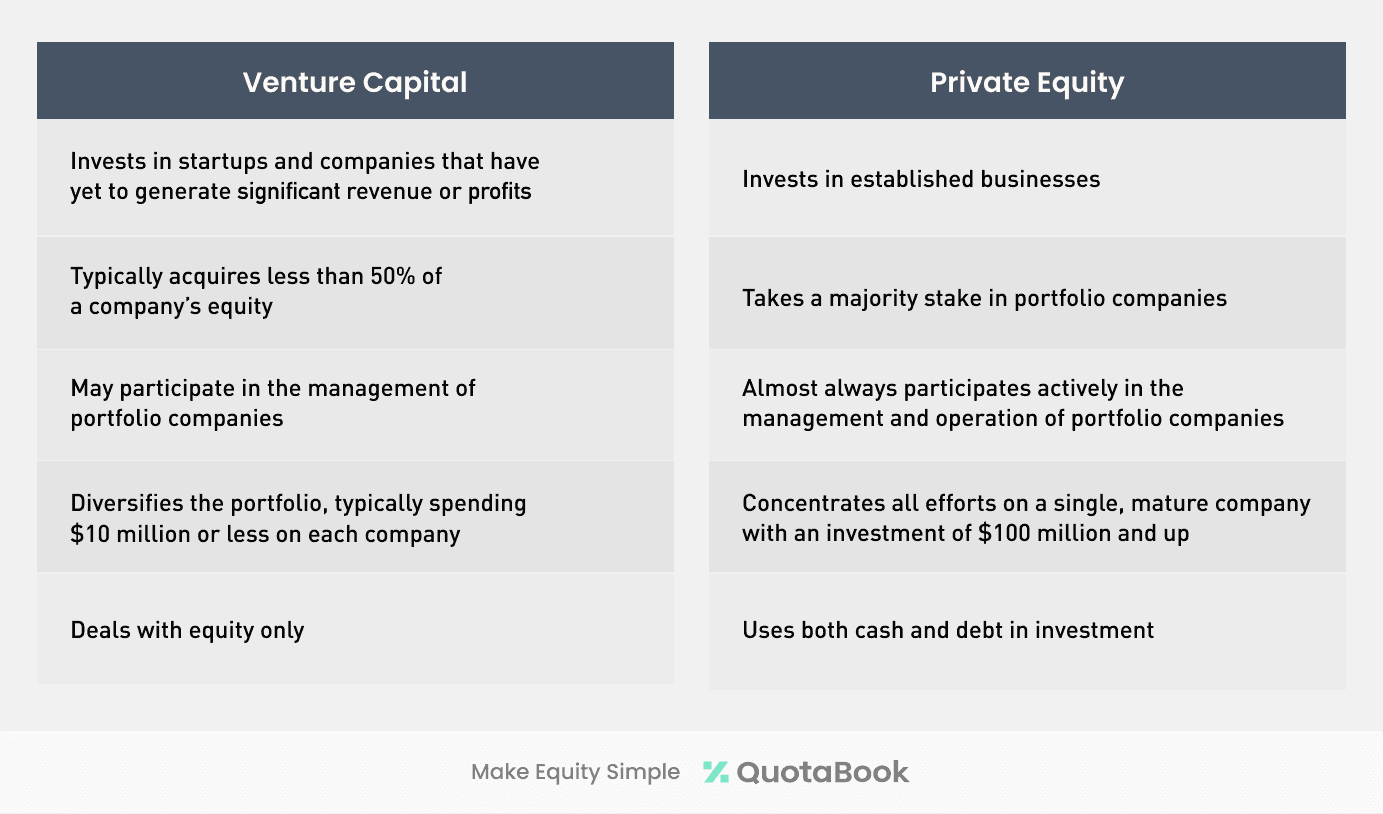

Strictly speaking, venture capital is a subset of private equity, but the two are often confused terms. Although they are similar in that they both generate profit when a portfolio company is sold or taken public, there are significant differences.

The Venture Capital Process

Any business looking for venture capital would first submit a business plan. If interested in the proposal, VC firm must then perform due diligence. This includes a thorough investigation of the company's business model, products, management, and operating history. Once due diligence has been completed, the VC firm will pledge an investment of capital in exchange for the company’s equity. These funds are typically provided in rounds, and the firm takes an active role in advising and monitoring the portfolio company’s progress before releasing additional funds. Generally, four to six years after the initial investment, the VC firm will exit the company by either selling their stake or initiating a merger, acquisition, or initial public offering (IPO).

It’s briefly explained above, but the venture capital process is a stream of communication between the company and the VC. The company must provide lots of required documents for due diligence, and after the funding, send a business report on a regular basis to update the VC. This demanding task would get much simpler with QuotaBook.

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.