Startup Accelerator

Startup accelerators are one of them, supporting early-stage startups along with other similar but distinctive institutions like incubators, angel investors, and venture capitalists.

What is a Startup Accelerator?

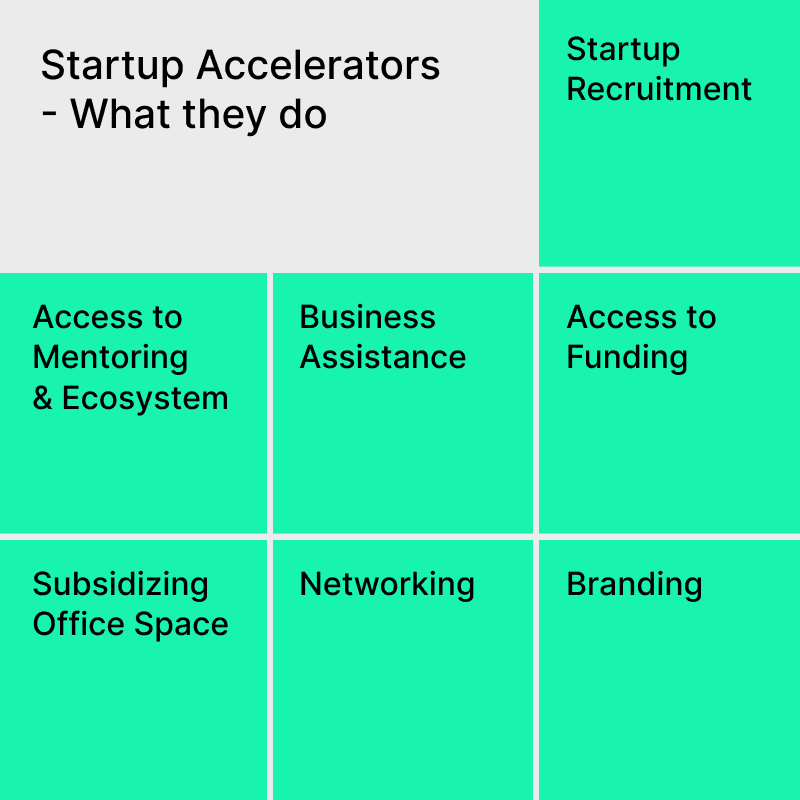

Startup accelerators support growth-driven companies in their early-stages through education, mentoring, and financing. Since it is aimed at accelerating the life cycle of young innovative companies, the accelerator experience is intense, rapid, and immersive, compressing years’ worth of learning-by-doing into just a few months. More than 200 accelerator programs are active in the US, and many more globally. The well-known Y Combinator and Techstars are investor funded, and there are other cases sponsored by universities or corporations. Just like any other equity funding, accelerators take startups’ equity (generally 5%~10%) in return for funds and guidance. While there are lots of confusions with other similar organizations such as incubators or angel investors, accelerators are said to be unique in their inclusion of all four criteria:

Fixed term (3 to 6 months)

Cohort based

Mentorship driven

Culminate in a graduation or “demo day”

The Process of Startup Accelerator

Apply & Get Accepted

The journey starts with an application. The most well-known accelerators are notoriously difficult to get into, with only 1~3% of applicants accepted at last. Startup founders applying for accelerator program are expected to have more than an idea, ideally a prototype or an actual product.

Get Funded

One of the main reasons the founders choose accelerator path is money. Accelerators typically offer seed money in exchange for equity in the company. The founders should keep in mind that this equity share may seem trivial now, but possibly become a substantial amount later and impact future fundraising rounds.

Focus

Accelerators usually operate on site, with coworking space provided. Entrepreneurs can fully focus and make progress in such immersive environments, which is definitely one of the big advantages of accelerator system.

Learn

Learning is another big part of accelerator program. Accelerators hold various seminars, workshops, and mentorship sessions. The topics are unlimited as long as they are relevant to launching a business, but some of the most valuable is often on the legal side and the pitching skill.

Network

Many accelerator participants say critical connections with potential investors as well as networking with peer founders are the most invaluable thing they got through the program. This is particularly useful for those who are new to the industry because they can quickly become part of the culture and develop a network in a relatively short period of time.

Demo Day

Accelerators culminate in a graduation, typically a ‘demo day’. Each startup in the cohort presents and pitches to a group of investors and the press. This is where the experience and time invested is really proven or not.

Is Startup Accelerator Always a Good Option?

Startup accelerator may seem to be undoubtedly good path for startups, but there are also disadvantages that should be considered. If the startup is not in the right stage for accelerator, either too early or too late, the benefits can’t be maximized. Moreover, the accelerator program can be a big distraction. High degree of commitment required by accelerators might rob the founders’ time that should be spent otherwise such as building product or hiring key staff. Startups should thoroughly go through these points to decide whether the accelerator program suits the company.

Graduation from accelerator is only the beginning. The fate of the startup depends on the capabilities fostered through the accelerator program. Unfortunately, there are a significant number of startups that fail to raise funds after demo day, with their valuation still set low. To survive and thrive, founders should endlessly strive for running the startup effectively and profitably, taking advantage of the connections when necessary. QuotaBook and QuotaSpace can help through this journey, supporting securities management and networking respectively.

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.