Pro Rata

“Pro rata" is a term commonly used during the financing process. However, it might sound unfamiliar to you if you don’t have the experience to raise investment. So, what does “pro rata” mean, and how can it be calculated?

What is Pro Rata?

“Pro rata” is a Latin term meaning “proportionally”. When something is given out to the people in the proportion of their possession to the whole, we call it that it is given on a “pro rata basis”. In the case of the investment process, a concept and calculation of pro rata are used in the situations such as determining the interest or dividend of the shareholders.

How to Calculate Pro Rata?

Calculating pro rata is very simple.

Fractional ownership = Number of the items owned / Total quantity of items

Pro rata distribution = Fractional ownership * Total amount of assets to be distributed

1. Allocate dividends per shareholder

When a company pays cash dividends out, the amount is determined on a pro rata share basis.

Assume a company called “Unicorn Inc.” has 200,000 shares outstanding. In this quarter, Unicorn Inc. announced that they will give off $100,000 as a dividend to their shareholders.

Anna is a shareholder of Unicorn Inc. She owns 5,400 shares. How much dividend will she receive?

Fractional ownership of Anna = 5,400 shares / 200,000 shares = 0.027 (2.7%)

Dividend Anna will receive = 0.027 * $100,000 = $2,700

Here, calculate the proportion of Anna’s share ownership, then multiply the percentage by the whole number of dividends.

2. Determine the interest rate

Some types of investments earn interest. For the calculation of short-term interest, pro rata calculation is used.

Unicorn Inc. pays interest to Harry for the investment of $10,000. The interest rate is 5% annually. How much interest accrues each month?

Monthly interest rate of Harry = 10% / 12 months = 0.83%

Interest accrues each month = 0.83% * (10% * $10,000)

= 0.83% * $1,000

= $8.3

The interest rate for each month is proportional to the annual monthly rate. Therefore divide annual interest by 12 months so that the interest rate of every month is equal. Then, multiply the monthly interest rate by the whole amount of annual interest to get interest accrues each month.

What are Pro Rata Rights?

“Pro rata rights” are the rights of shareholders that guarantee participation in the future investment round. Startups, especially those that are in early-stage, go through several rounds of investment as they grow up. Dilution of existing shareholders’ equity is inevitable during this series of investments. Although equity dilution is not always a bad thing, some investors want to keep their percentage of ownership to get a greater return for their investment or to keep their other rights. Therefore, those who don’t want dilution of their ownership can exert pro rata rights to participate next investment round.

Pro rata rights are not given to all investors. Generally, early-stage startups grant this right to people who help the company a lot, and late-stage startups grant this to the major investors. This is a right not an obligation, so even if a person owns pro rata rights, they don’t necessarily need to participate in the next financing round. Also, new investors or existing investors who don’t have pro rata rights can still participate in further investment rounds. This is just to ‘guarantee’ space for further investment if a holder of the right wants to participate.

The pro rata calculation might look a little bit different in this case. Let’s see the example.

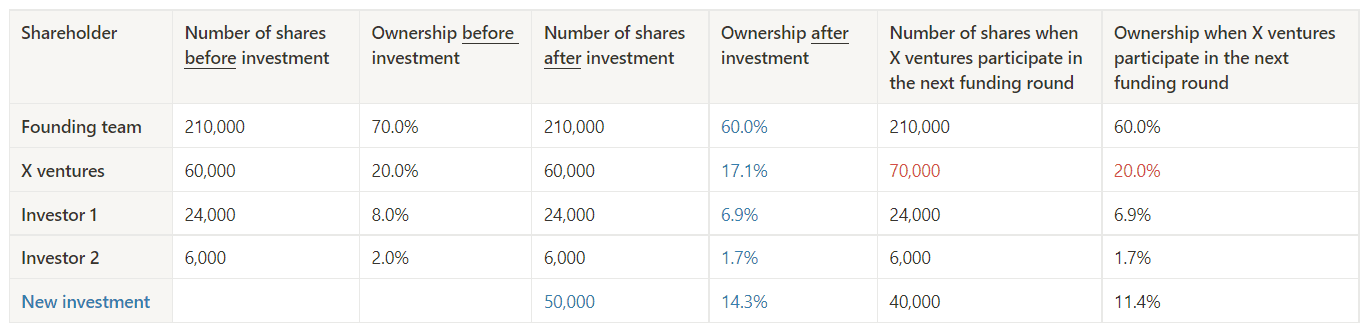

X ventures has invested in Unicorn Inc. for a seed round, and taken 20% of the company. A year after, Unicorn Inc. raises series-A funding at $3M pre-valuation. The total number of outstanding shares is 300,000 and the price per share is $10. Unicorn Inc. plans to raise $500K so, 50,000 shares will be newly issued.

X ventures wants to exert its pro rata rights to keep its percentage of ownership. How much should X ventures invest for the next round to keep 20% ownership?

Firstly, calculate the number of shares that takes 20% of the company after the investment

Then calculate the number of shares that X ventures owns before the investment

Determine how many shares to buy by subtracting (2) from (1)

Multiply (3) by price per share to calculate the total amount to invest for the next round

*Total number of shares after investment

= total number of shares before investment + newly issued shares

= 300,000 + 50,000

= 350,000 shares

1. Number of shares to keep 20% ownership after investment

= 20% * total number of shares after investment

= 20% * 350,000

= 70,000 shares

2. Share numbers of X ventures before investment

= percentage ownership * total number of shares

= 20% * 300,000

= 60,000 shares

3. Number of shares that X ventures has to buy

= 70,000 - 60,000

= 10,000 shares

4. Amount that X ventures has to pay

= Number of shares to buy * price per share

= 10,000 * $10

= $ 100,000

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.