Option Pool

As we have covered in the previous QuotaWiki series, startups use stock options to attract and retain talents and motivate them, while keeping the cash burn rate from overly increasing at the same time. Being a part of reasonable expectations when joining a startup, stock options have become an industry norm nowadays.

What is an Option Pool?

Since stock options are issued in equity shares after vesting, it inevitably affects the shares of founders and investors. To avoid requesting investor consents for each stock option grant, option pool is determined before the round of fundraising. So basically, option pool is a block of shares set aside for employees, typically accounting for about 20% of total shares. This enables founders to secure stock options for new hires, and investors can set a limitation on the possible dilution.

What is an Option Pool Dilution?

The creation of the option pool will naturally result in dilution because other shareholders must have their total stake reduced to accommodate this new equity. Option pool creates dilution for both founders and investors, and therefore is a point of negotiation during a fundraising round. There are two ways to calculate the dilution from the option pool.

Pre-money Valuation

Carving out the option pool from the pre-money valuation means all the option pool dilution impacts the founders and existing investors. New investors would thus avoid any dilution from the creation of the option pool.

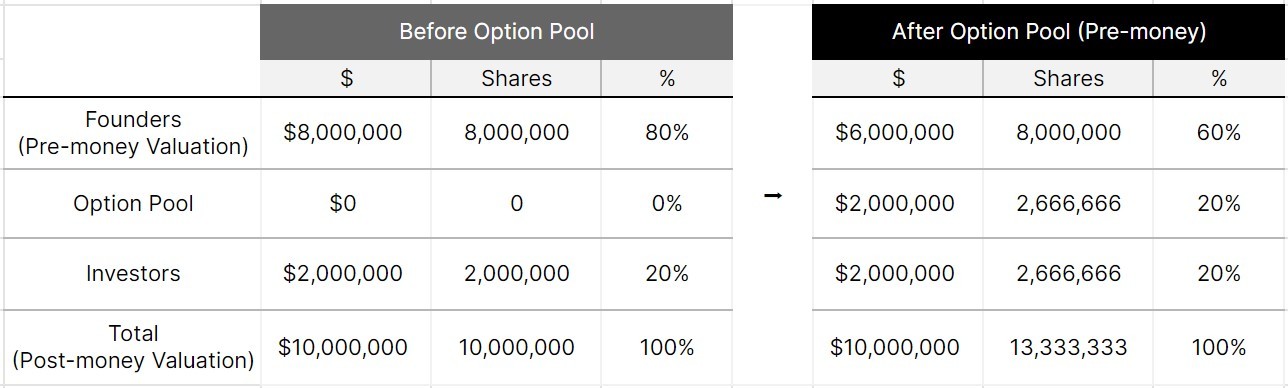

Take a startup heading into its Series A with 8M shares outstanding and no option pool, for example. It plans to raise $2M, and the investors offer a pre-money valuation of $8M – adding up to $10M of post-money valuation. A quick calculation come up with the stock price valued at $1 per share ($8M pre-money valuation divided by 8M outstanding shares), but things change if investors meant this pre-money valuation to include an option pool equal to 20% of the post-money valuation. This means that the effective valuation of the startup was $6M. Investors raised it to $8M to create $2M option pool (20% of $10M post-money valuation). As a result, valuation of stock price is decreased to $0.75 per share ($6M divided by 8M shares), and the founders’ stake is also diluted to 60% (20% option pool deducted from 80% pre-option pool founders’ stake). Meanwhile, the investors will be free of dilution, maintaining their 20% stake.

Post-money Valuation

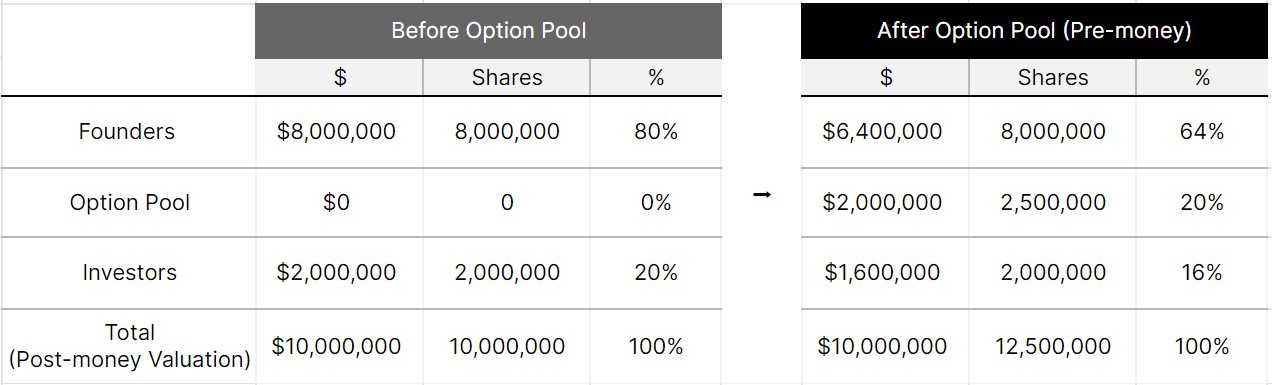

On the other hand, if the employee option pool is carved out from the post-money valuation, that means option pool dilution is equally distributed to everybody including new investors. Continuing from the assumption of the example above, founders and investors will each hold 80% and 20% stake before the creation of the option pool. But this time, the investors had agreed to carve out the 20% option pool from the post-money valuation, meaning everybody gets diluted by 20%. As a result, the founders will hold 64%, the investors 16%, and the option pool 20%.

How can I better manage Employee Stock Option Pool?

Negotiating the size of the option pool with the investors is tough. Even after that, managing any changes to the option pool or keeping track of the number of shares granted or remaining in the option pool with numerous employees is also challenging. QuotaBook can help you manage the status of the option pool.

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.