General Partner & Limited Partner

Getting an investment is more than just receiving money. Investors have rights, responsibility, and liability for the business they invested in. Therefore, knowing who they are and choosing the right partnership is important.

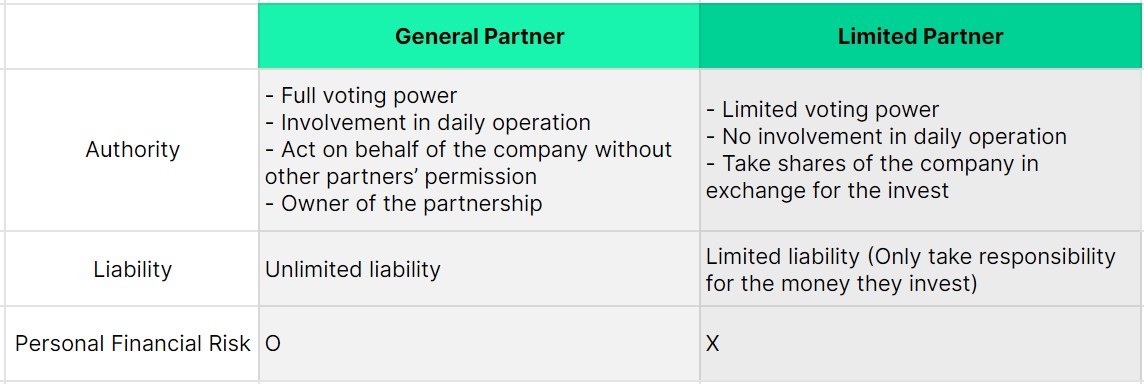

General Partner

A general partner is an owner of the partnership who can act on behalf of the company without permission from other partners. Often they have specialized knowledge in the business field they invest and devote their time to getting involved in daily business operations. However, note that the general partner also has unlimited liability for the partnership. If the company they invested in acquired financial debt or liability, legal responsibility might be passed on to them. A general partner with the most money invested receives the larger proportion of the penalty. Sometimes, the general partners even bear a risk on their personal assets if they are required to meet a financial obligation.

Limited Partner

A limited partner invests money and takes shares of the company. A difference from the general partner is that the limited partner has limited voting power and does not get involved in daily business operations. While taking less responsibility and authority, a limited partner has a limited liability and the loss will be no more than the amount they invest. However, if a limited partner is proven to have an active role or get involved in daily operations, they also can be subjected to bear the liability with their personal assets.

General Partnership & Limited Partnership

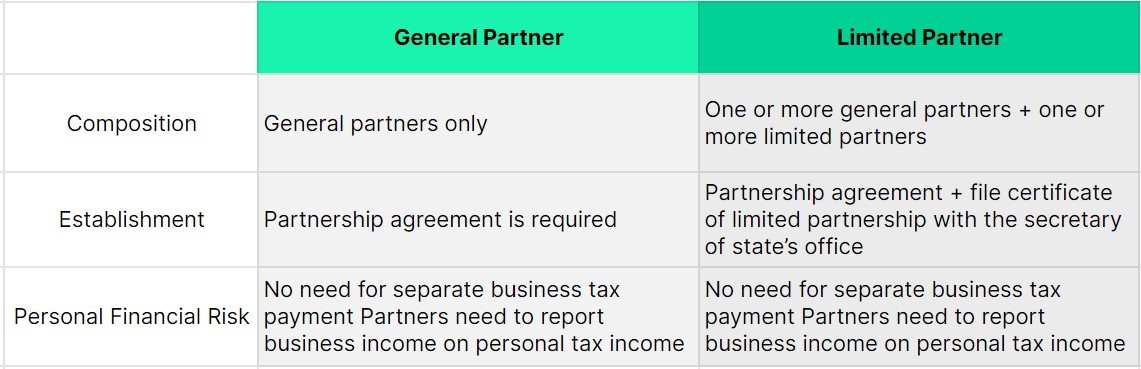

General Partnership

A general partnership consists of two or more general partners. In order to establish a general partnership, partners only need to sign a partnership agreement, and should agree to take responsibility for the debt and losses that come from the partnership. They will then have full authority to involve in business management and operation, and usually the ownership responsibility is placed equally on all partners in the general partnership. In terms of tax-paying, a general partnership is regarded as a pass-through entity. The owners don’t need to file separate business taxes, but instead, they have to report business income on their personal tax returns.

Limited Partnership

A limited partnership is composed of at least one general partner and one or more limited partners. While a general partner handles daily operations, limited partners have limited authority and liability. Establishing a limited partnership requires one more step compared to a general partnership. Once all partners signed the partnership agreement, they have to file a certificate of limited partnership with the secretary of state’s office of their state of operation. Like a general partnership, a limited partnership is regarded as a pass-through entity. Therefore, they don’t need to pay separate business taxes as well.

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.