Capitalization Table (Cap Table)

What is a cap table?

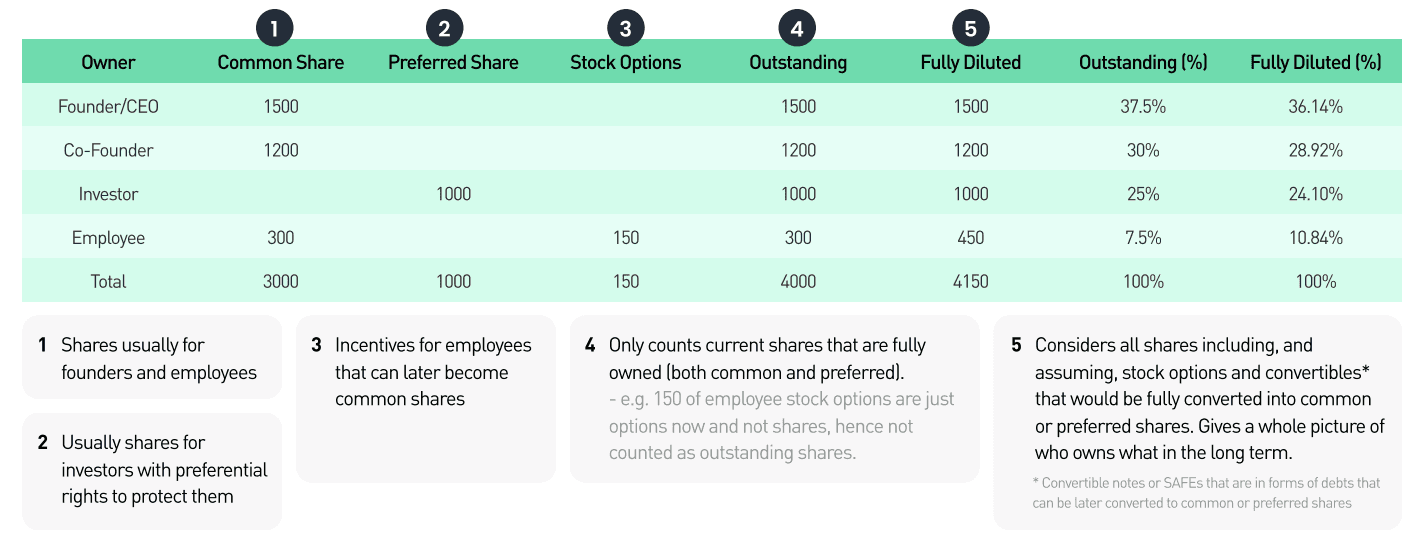

A capitalization table (or cap table) provides an analysis of the ownership of all the securities your company has issued. It includes each stakeholder’s percentage of ownership, types of securities, equity dilution, and value of equity in each round of investment. Cap table helps private companies to calculate their market value, especially when making financial decisions involving equity ownership, and market capitalization.

What should be included in a cap table?

Names of shareholders

Types of shares issued

Number of shares issued

Number of stock options

Total number of outstanding shares

Number of remaining shares available to be issued

When is a cap table most needed?

Raising investments: New investors are interested in seeing how the company’s ownership is structured and how their investment affects the company.

Selling the company: The cap table lays out how much each shareholder receives from the proceeds and in what order.

How can I better manage my cap table?

Many startups often use spreadsheets for cap tables. Excel is a good tool when you have a simple capital structure and a small number of stakeholders. However, when the business grows it becomes difficult to keep every data up-to-date on a spreadsheet. After multiple funding rounds, the cap table becomes more complex but tracking the data on your spreadsheet does not scale as your company does. Eventually, you need a tool to streamline your cap table management and this is when a tool like QuotaBook becomes handy.

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.