How to Grant Employee Stock Options

Employee Stock Options are an equity compensation that gives an employee a percentage of ownership of the company. Employee Stock Options have multiple elements and can be tricky to manage as more stakeholders join in.

Make an Employee Stock Option Plan

1. What is an Employee Stock Option Plan?

An Employee Stock Option Plan is an employee benefit plan that grants Employee Stock Options, which is a right to purchase company shares at a later date.

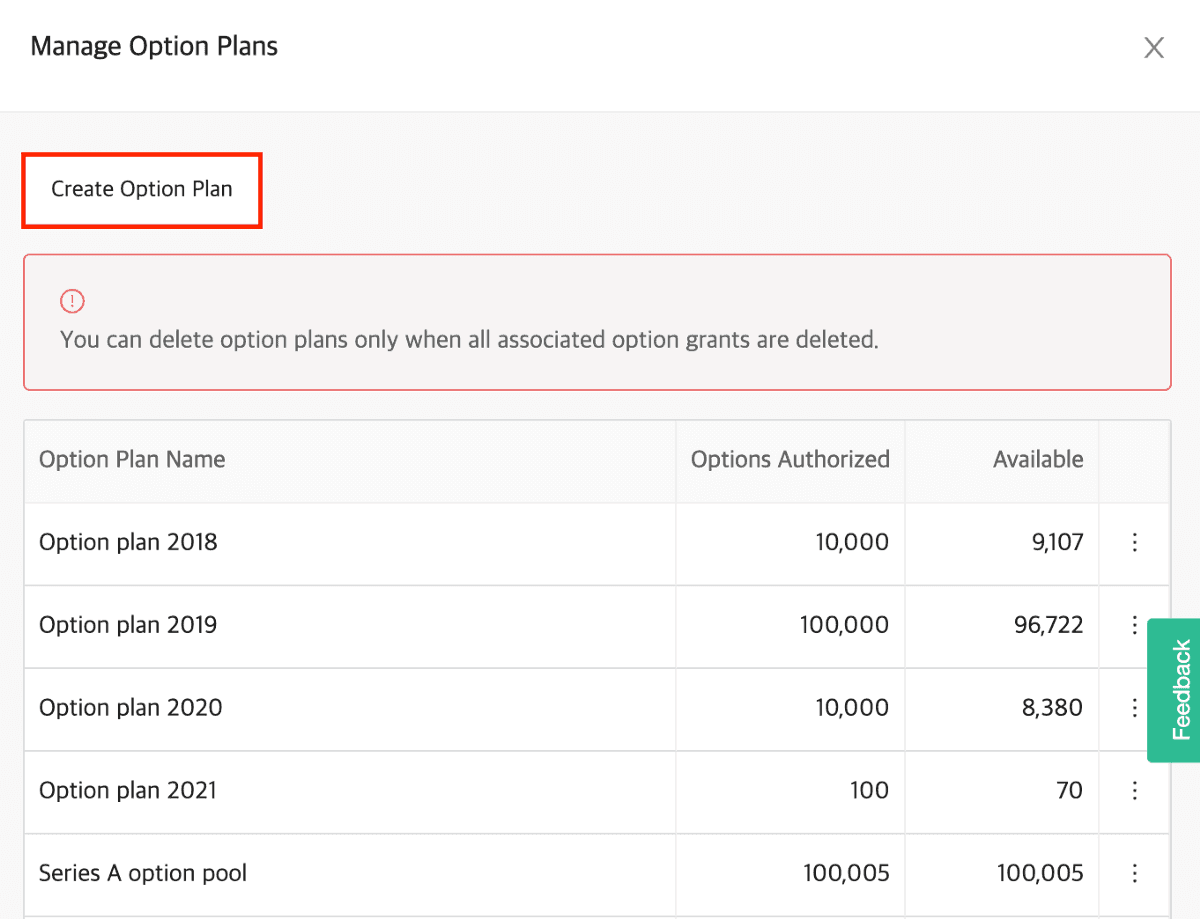

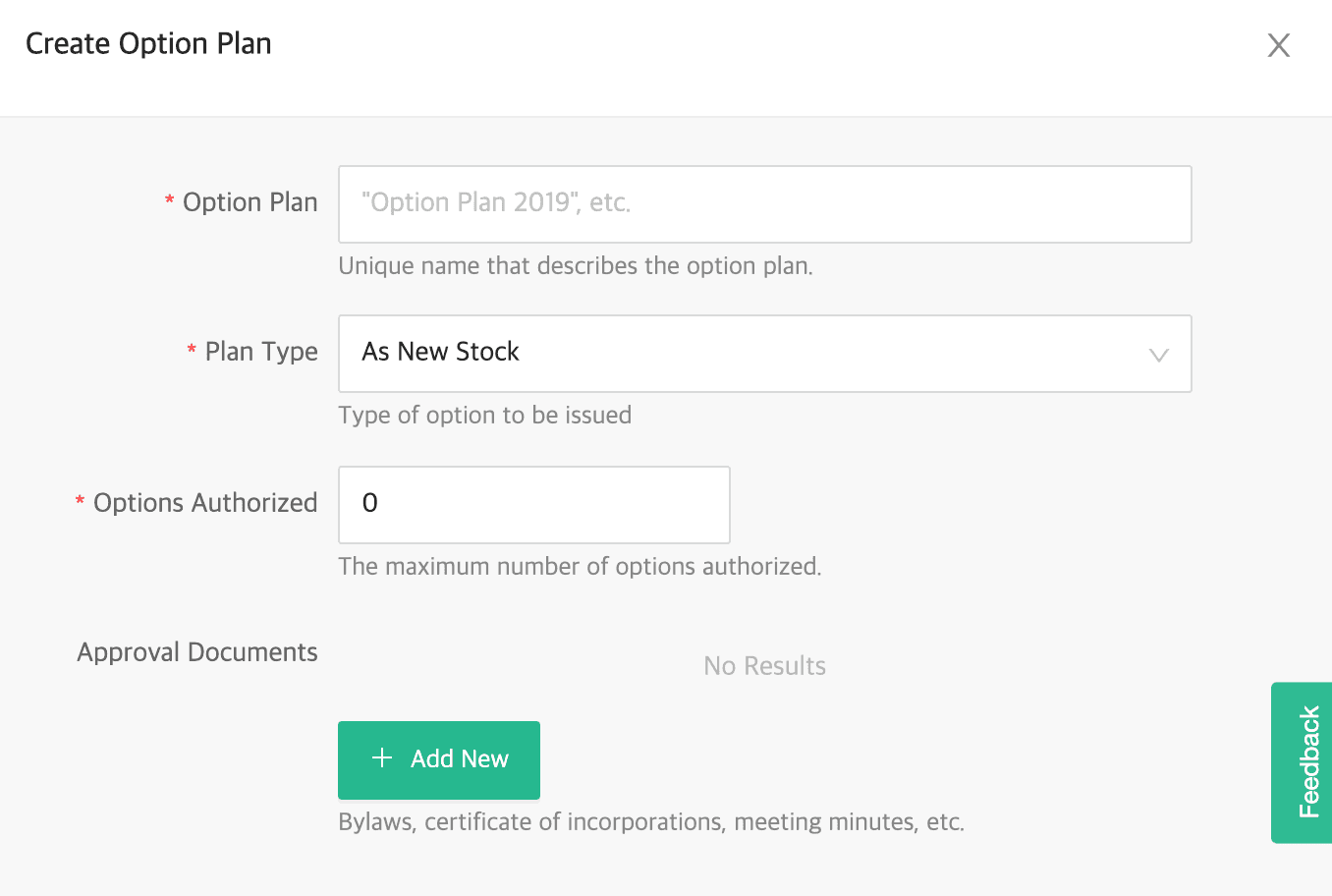

You can add different types of option plans depending on how they will be managed.

You can choose from New Stocks, Existing Stocks or Cash to grant your employees in an option plan. Each ESOP will also have a vesting schedule.

* Closing a funding round, issuing more stock options?

You can simply edit the maximum number of options authorized to issue more stocks options.

2. What is a Vesting Schedule?

Typically, even after granting stock options to employees through grant letters and signatures, they do not own shares and cannot exercise stocks right away. Stock options that were granted must be first vested to the employees before they can actually exercise, sell and cash out. Vesting simply means that employees have to earn their shares over time on condition(s). The number of options vested increases over time on a schedule. This schedule is called a vesting schedule.

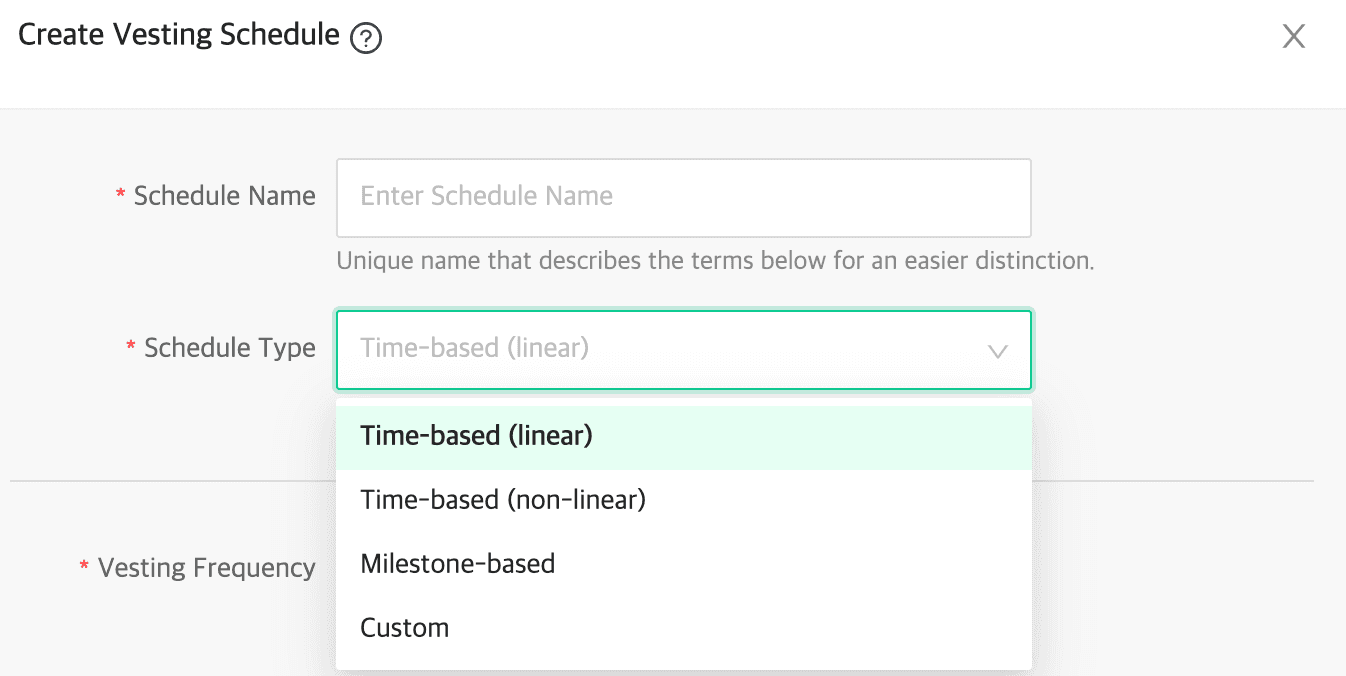

A Vesting Schedule determines how many stock options will be vested and when, depending on terms such as employment duration and milestone.

3.What is Time-based Vesting?

Time-based vesting allows employees to earn their shares over time. Time-based vesting schedules often have a cliff, which is the duration of time before the first promised portion of the stock is vested. When the cliff hits, the first portion is vested. The remaining options are gradually vested over time, typically every month or a quarter.

Example: 4 Year vesting schedule with 1 year cliff (total 1,000 shares):

1st year from the option grant: 250 shares vested

2nd year: 250 shares vested

3rd year: 250 shares vested

4th year: 250 shares vested

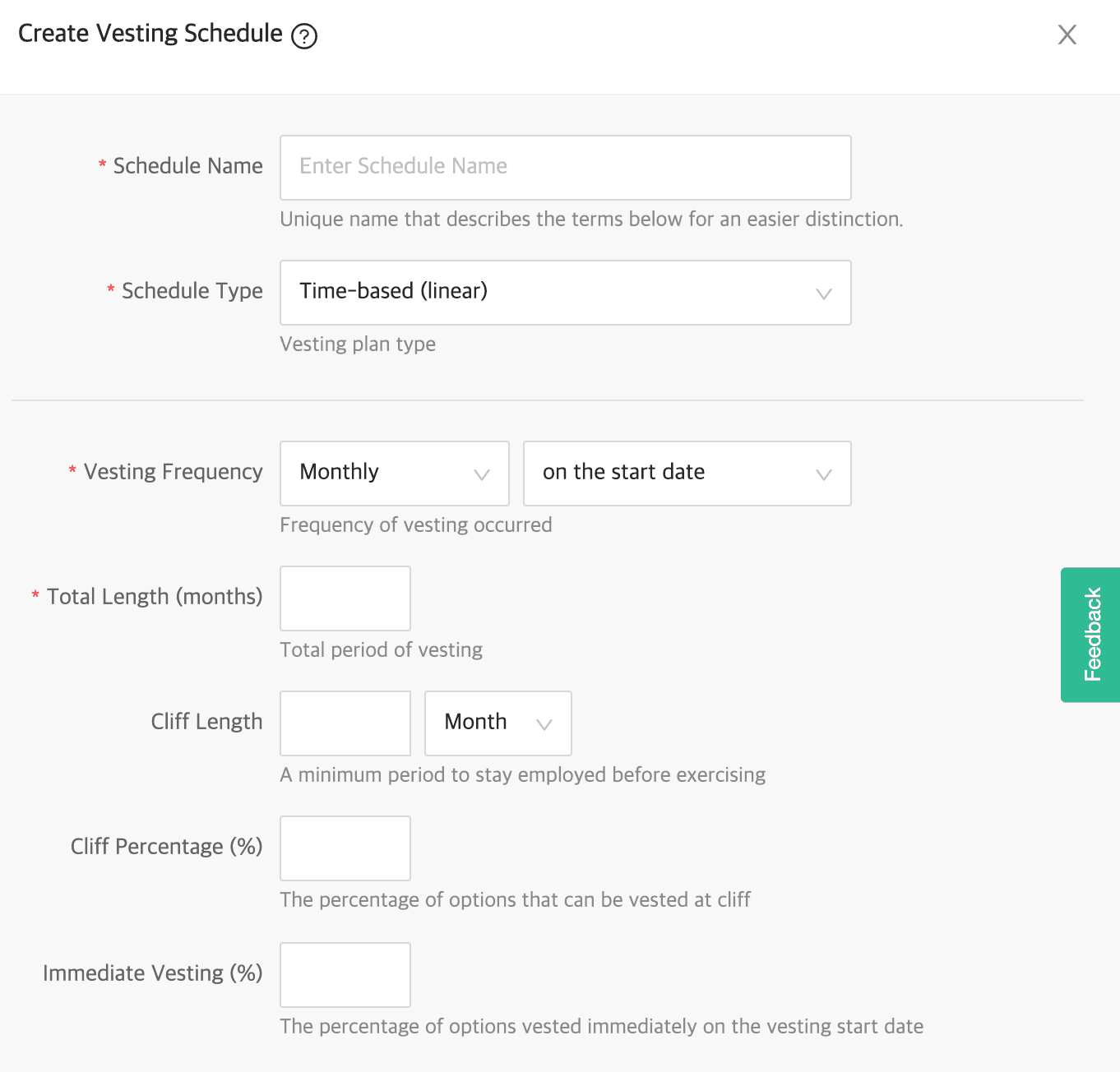

On Quotabook, you can create a vesting schedule of your choice, setting a unique vesting duration, cliff and frequency for each plan. You can set the details of a vesting schedule, reflecting the differing terms in stock option agreements with your employees.

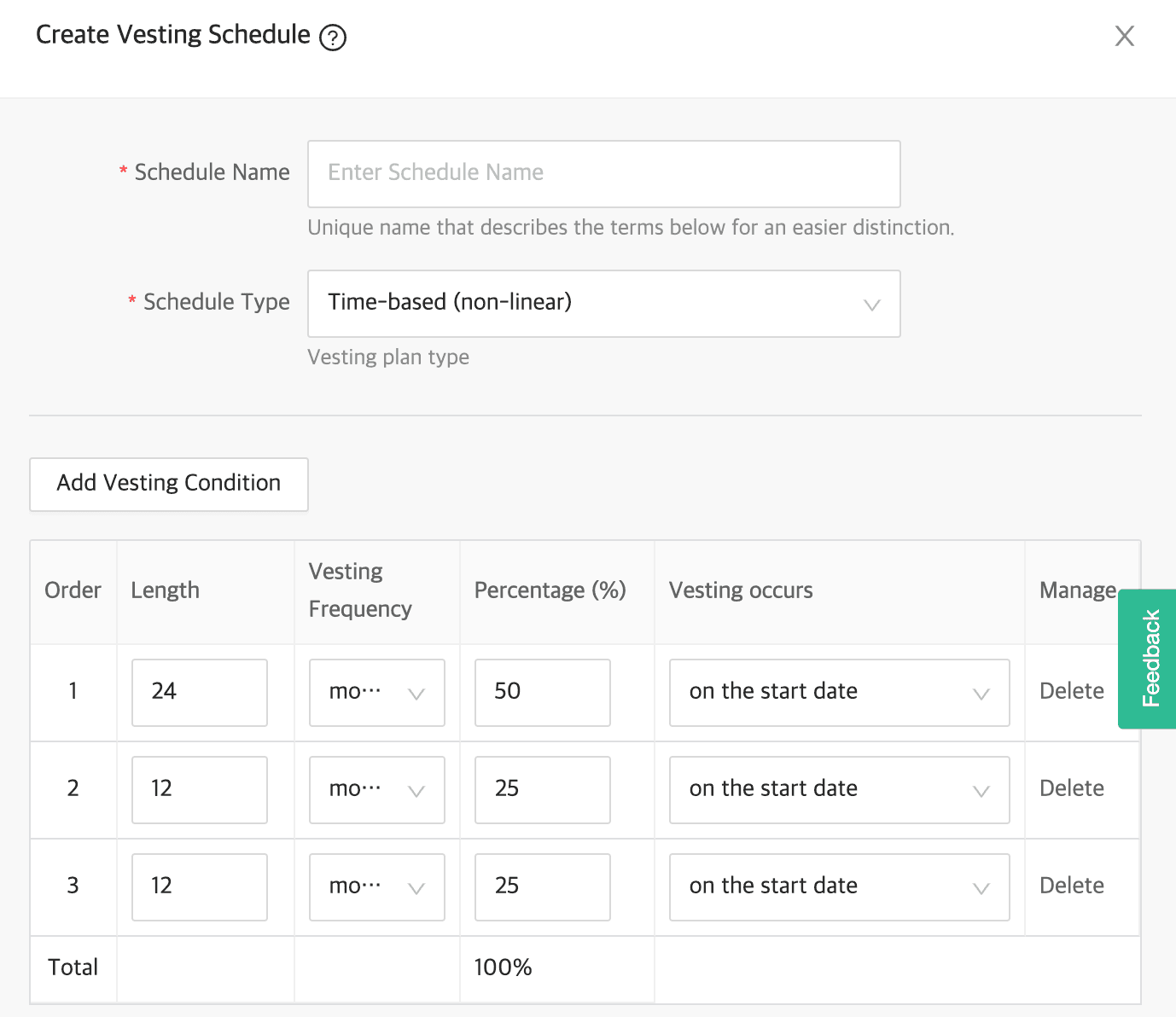

You may also make a non-linear vesting schedule when the amount of vested stock options does not increase linearly. (e.g. 50% vested after 2 years, 25% after a year … ).

4.What is milestone vesting?

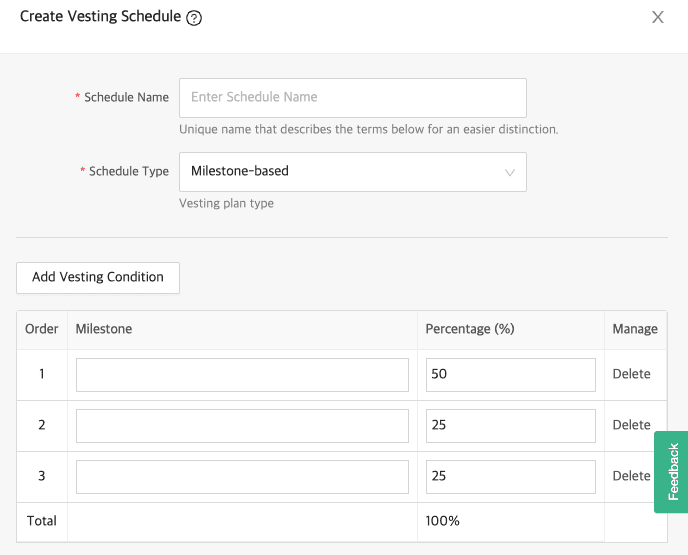

Milestone vesting lets employees to earn their shares if they reach specific milestones. (e.g. sales performance, marketing KPIs).

You can create a milestone vesting schedule reflecting performance indicators or KPIs of your choice.

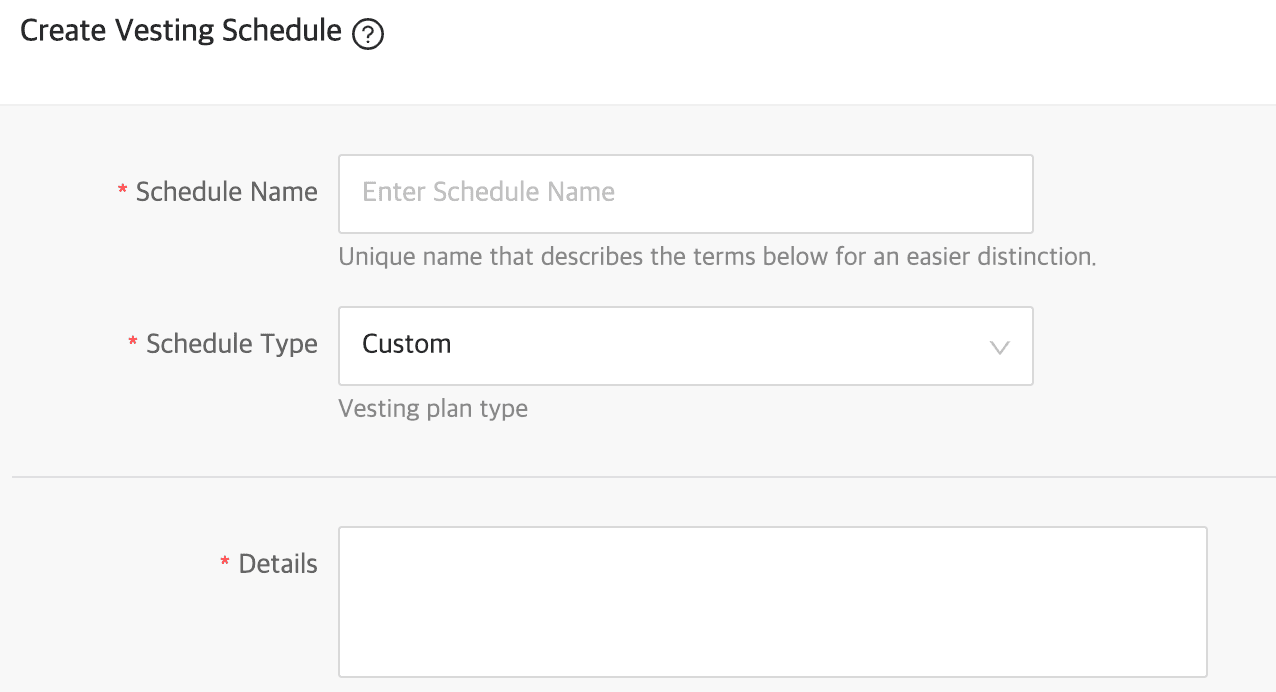

You may also create a custom vesting schedule not linked to time or milestone achievements.

5. How to Grant Employee Stock Options

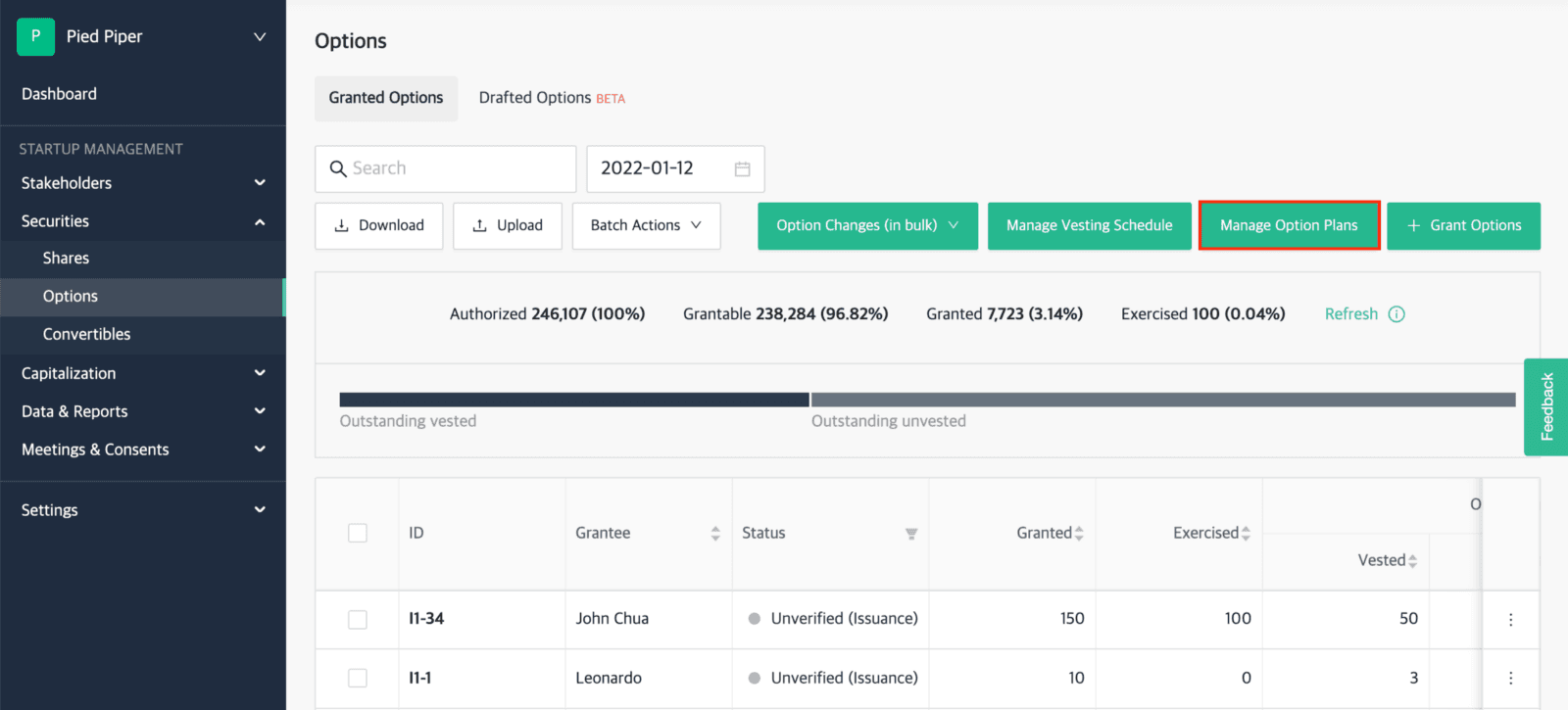

Once you have successfully created an ESOP and its vesting schedule, you are now ready to grant and record stock options on QuotaBook!

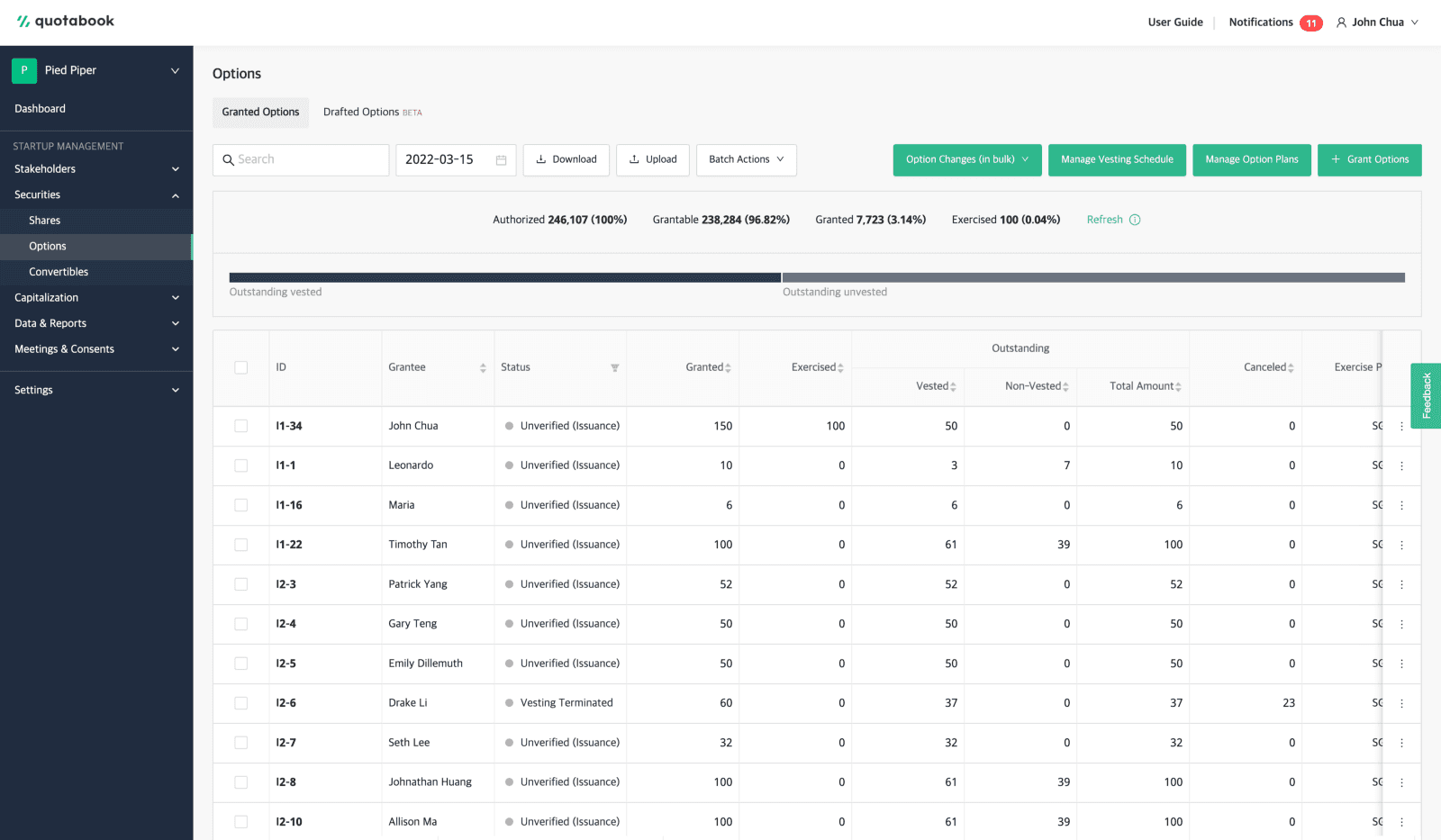

You can view and manage a cap table of all stakeholders who hold stock options of your company.

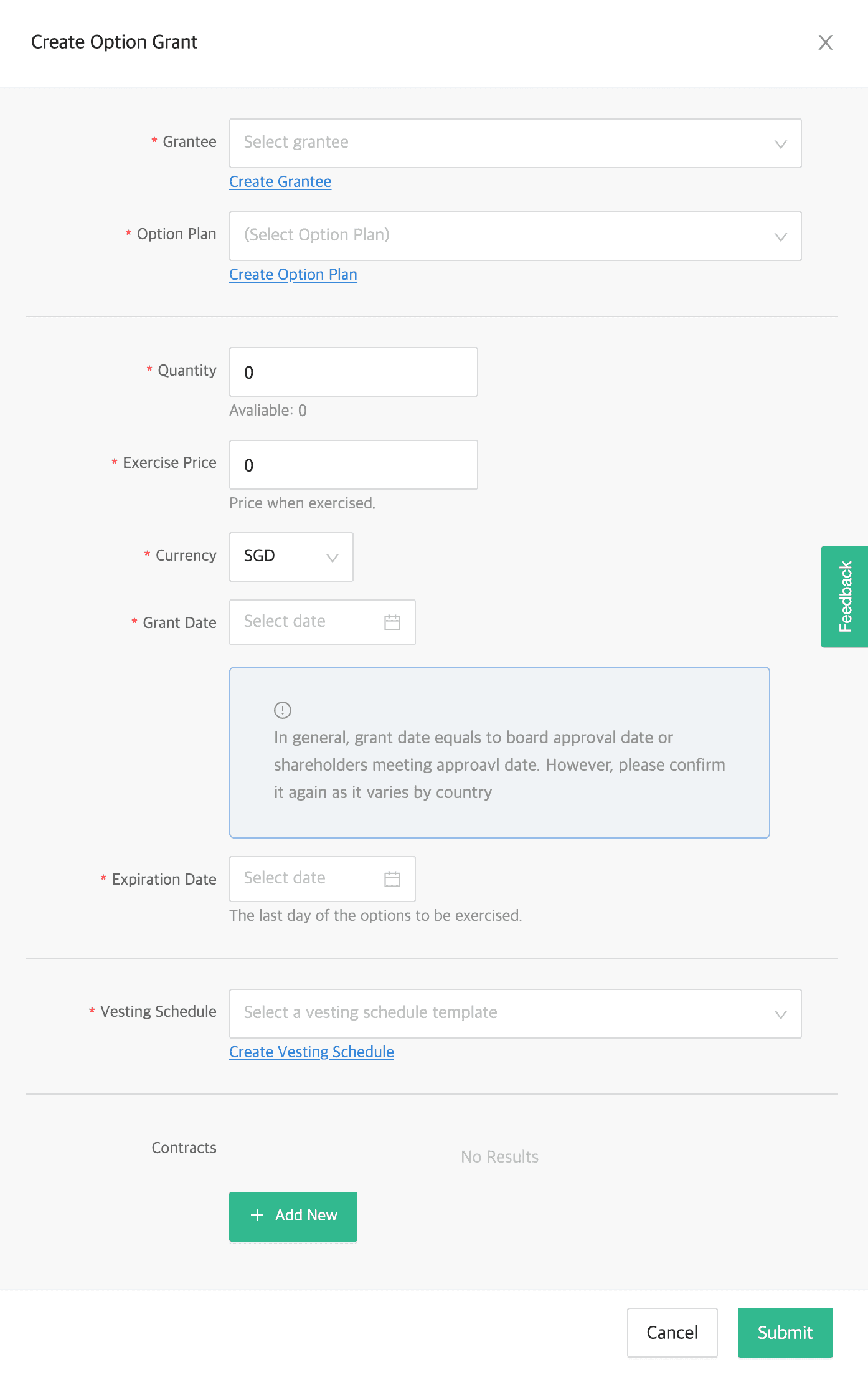

Select an employee you want to grant options (grantee), and click and option plan you already created. Or alternatively, you can create a plan directly from the [+Grant Options] window.

Fill out the necessary information and attach contracts if any, and you’re done!

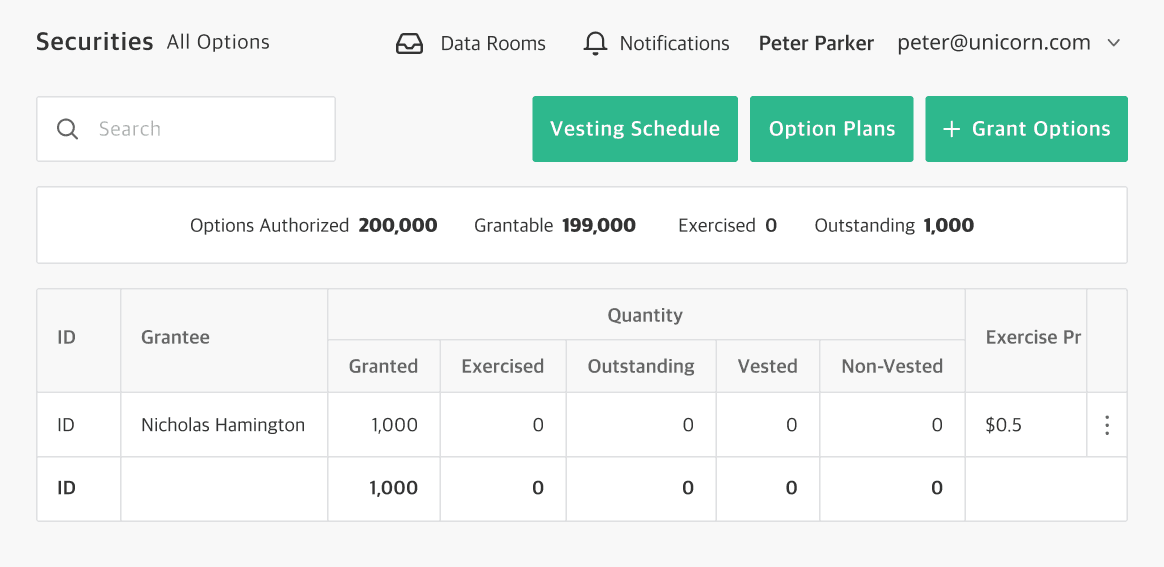

The granted options will be added to the cap table as below:

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.