What is an Employee Stock Option Plan?

What is an ESOP (Employee Stock Option Plan)?

An Employee Stock Option Plan is a contract between employee and employer that grants stock options. In other words, employees have a right to purchase the company shares at a set price over set a time window.

Please note that we used the term Employee Stock Option Plan, as opposed to Employee Share Ownership Plan.

What is the difference between an Employee Stock Option Plan vs. Employee Stock Ownership Plan?

*Note: Employee Stock Ownership Plan is not necessarily the same thing as Employee Stock Option Plan. Employee Stock Ownership Plan is a retirement plan where an employer contributes its company stock to the benefit plan of an employee. Employee Stock Option Plan can be seen as a type of Employee Stock Ownership Plan.

How is an ESOP structured?

1. ESOP Agreement

We learned last time that Employee Stock Options are not the actual share ownership. Employee Stock Options are the rights granted to employees. These rights must first be brought into existence. This is why your company first needs to create a thoughtfully written ESOP agreement.

“Let there be Employee Stock Options.” - ESOP

Now that you have brought your company’s Employee Stock Options to existence, you want to start thinking about where to put them.

2. ESOP Pool

You have to create an ESOP pool for your company that will set aside a pre-determined % of equity shareholding for your employees. In general, companies set aside about 10-15% of their employee stock options for employees.

In order to keep everyone happy, you want to make a prudent decision on how much to set aside for the board and for the rest of employees.

3. ESOP Committee

Now that we have a vast pool of Employee Stock Options wading and floundering unsupervised, we need someone to manage this pool before they drown.

An ESOP agreement should also set the details of an ESOP Committee.

An ESOP committee is responsible for managing the ESOP pool and recommending necessary actions to the Board of Directors. ESOP committee is generally made up of company’s directors and officers. So now we have some lifeguards keeping an eye on our children (stock options) in the pool.

4. Cliff & Vesting Period

May skip if you have already read our last post on Employee Stock Options.

What is a Cliff?

An Employee Stock Option Plan could have a cliff and a vesting period per ESOP.

Employee Stock Options are generally given over a period of time, and not all at once. This distribution of stock options over time is called vesting, which means employees will earn their share over a period of time. Vesting encourages employees to stick around longer and perform better.

Cliff is a time period within which no vesting can occur. It refers to the time period before an employee can receive the first promised portion of the stock.

During the cliff, no stock options are vested. If options are not vested, employees cannot exercise them. To exercise stock options means to buy a set number of stock options at a set price — called exercise price, or strike price — that is lower than the market price.

When the cliff hits, the employee can exercise the first portion of the promised benefit.

If employee resigns during the Cliff period, they will NOT receive any stock options. It is important to set these arrangements clearly in the stock option agreement. A typical cliff period for startups is one year.

What is a Vesting Period?

We saw that stock options are vested, and employees have to work to earn their share of an asset. The number of options an employee can exercise increases over time on a schedule, called a vesting schedule.

Vesting period is a period of time before all ESOP shares become fully, and unconditionally owned by employee.

In the graph above, the cliff lasts for a year, and the vesting period lasts for four years.

If the employee resigns during the vesting period (usually after the Cliff), they will be given pro-rated stock options based on the length of employment.

What is a selling restriction?

In Singapore, you can include a selling restriction, which is a period of time where an employee is not allowed to sell their shares.

Selling restrictions will affect how gains from ESOP plans are taxed for employees, so be sure to research or receive proper consulting on whether and how to set this selling restriction.

How to Create an Employee Stock Option Plan

So now you understand why it is important to create and manage ESOP for your employees and your company’s growth, but with so many employees coming and going, managing everything manually could easily be a recipe for a disaster.

On QuotaBook, you can create different types of Employee Stock Option plans, letting you digitalize the entire process at just one click.

1. Manage Several Option Plans

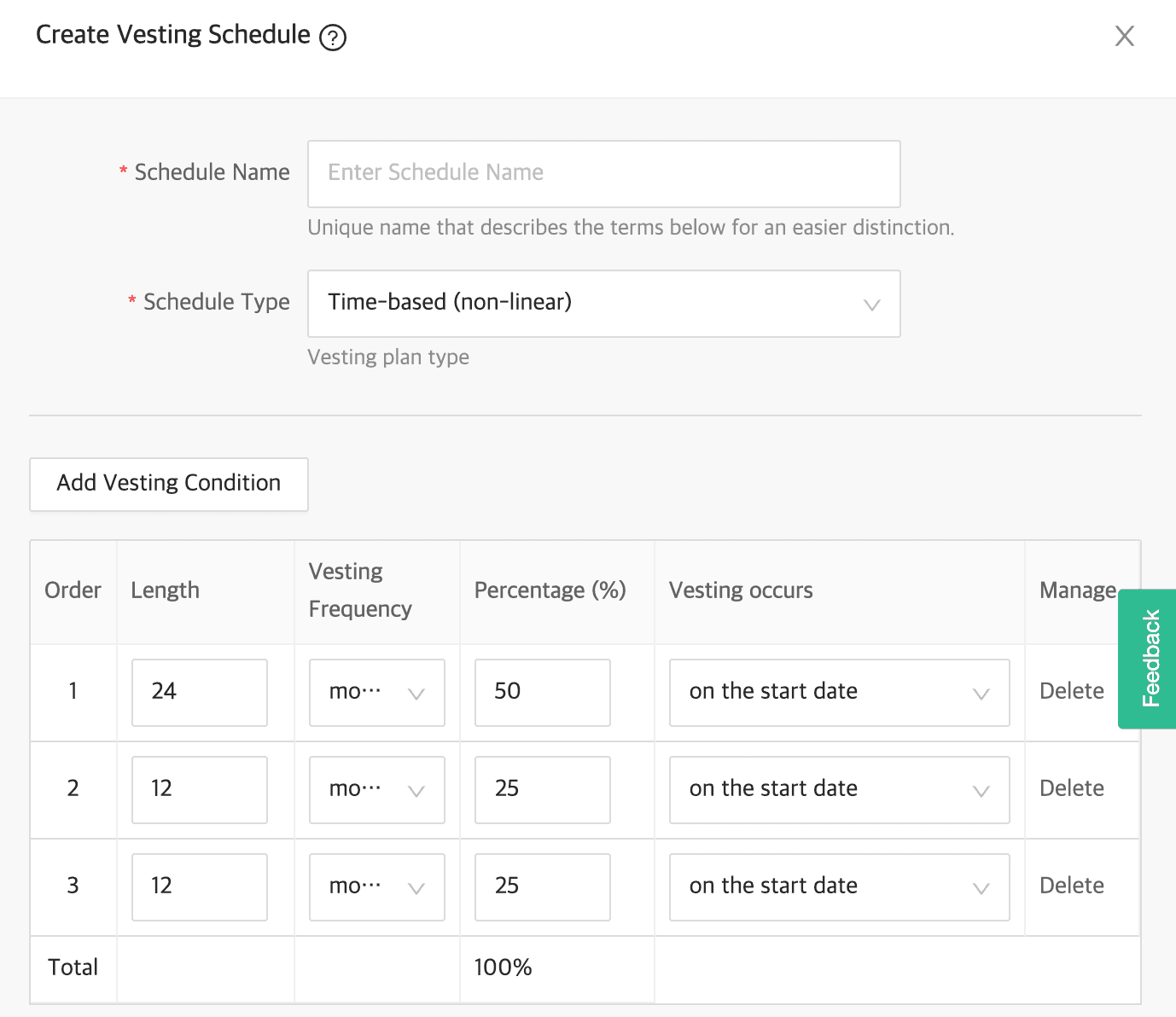

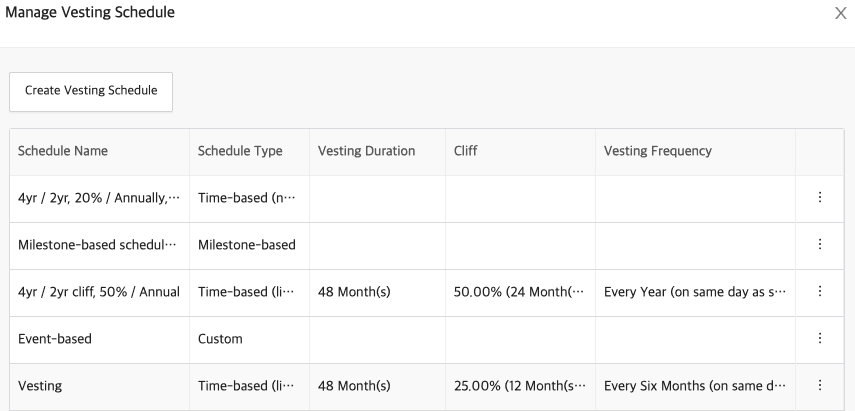

2. Make & Manage Vesting Schedules

3. Grant Stock Options

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.