What are Employee Stock Options?

What are Employee Stock Options (ESOs)?

TL;DR

An Employee Stock Option is an equity compensation that gives an employee a percentage of ownership of the company.

An ESO is a right to purchase a set # of company shares at a set price starting from a set date. (STOCK OPTIONS ≠ OWNERSHIP OF ACTUAL STOCKS)

Exercise price = The fixed price at which employees can buy their shares

Stocks will VEST — you earn promised stock options over time, on condition(s)

Read your stock option agreement: KNOW YOUR TERMS

Every startup dreams of becoming a unicorn. While relishing in the pure joy of creating world-changing solutions, a minor potential benefit we often forget about is the unfound possibility of financial compensation in the future.

This compensation often includes stock options. Stock options are complicated. Finance is complicated, when it’s really a lot of big words. Don’t worry, we’ll cover what you need to know.

What are Employee Stock Options?

Many startups and other employers offer employee stock options as part of a compensation package. An Employee Stock Option is an equity compensation that gives an employee a percentage of ownership of the company. A company sets aside a portion of shares for employees, promising their piece of pie.

Why Does a Company Issue Stock Options?

Reward early employees when & if the company goes public

Incentivize employees to work harder to grow the value of shares

Broke companies can employ talent even when they are lacking cash at the moment

Retain talent for the promise of growth

You get a piece of the company. You work harder so your company can grow. The company saves cash they are lacking at the moment. It’s a win-win situation for both employees & employers.

But is it really that simple?

Your CEO put down a bag of stock options in front of you. Congratulations! You’re soon-to-be a millionaire when that stock hits the IPO. Unfortunately, getting your piece of pie is not as simple.

An employee stock option is a “right” to purchase a set number of company shares at a given price starting from a specific date.

This pre-determined price is called an exercise price. The date when employees can receive their stock options for the first time is called the grant date. Employees cannot exercise their right to purchase their shares before the grant date.

Note that these stock options will also expire at some point in time. The employee will have to exercise their options before they expire, within a given period of time. Exercising means employees will buy the a number of shares at the exercise price. The give time period is called the exercise window. The date when the stock options expire and can no longer be exercised is called the expiration date.

So, receiving stock options for 100 shares DOES NOT MEAN that 100 shares of the company will be added to your Robinhood account the next day. It means that you have a right to buy 100 shares at a set price, starting from a set date.

REMEMBER, STOCK OPTIONS ≠ OWNERSHIP OF ACTUAL STOCKS

At this point some of you might wonder, how would a company retain their employees with stock options? What if you join a company just about to hit IPO, and you dip the next day with bags full of cash to where nobody can find you (in a very hypothetical world)? Congratulations! Time to purchase some yachts.

Sadly, there is little chance of this script becoming a reality as most companies vest stock options.

What is Vesting?

Vesting is a process through which employees earn their shares of an asset. When stock options are awarded (granted), employees can’t just exercise all of their stocks right away. The number of options you can exercise increases over time and on a schedule. This schedule is called a vesting schedule. A vesting schedule determines when and how many stock options employees can exercise at each time. Vesting encourages employees to stick around longer and perform better.

There are three main types of vesting:

1. Time-based vesting

Employees earn their stock options over time on a set schedule.

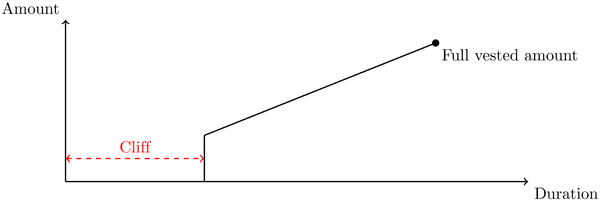

In general, there is a cliff, the time period before the employee can receive the first portion of the promised stock. The remaining amounts are vested over time.

2. Milestone vesting

Employees earn their stock options when they complete specific tasks or hit objectives set by employer.

ex. A salesperson can have stock options after they sold # units

ex 2. An accountant can have stock options after they completed X number of audits per month

3. Hybrid vesting

Employees earn their stock options after staying for a specific period of time AND reaching a specific milestone.

Time-based vesting + Milestone vesting

ex. A salesperson can have stock options after they sold # units

ex 2. An accountant can have stock options after they completed X number of audits per month

Things to consider when you are exercising stock options — for Employees

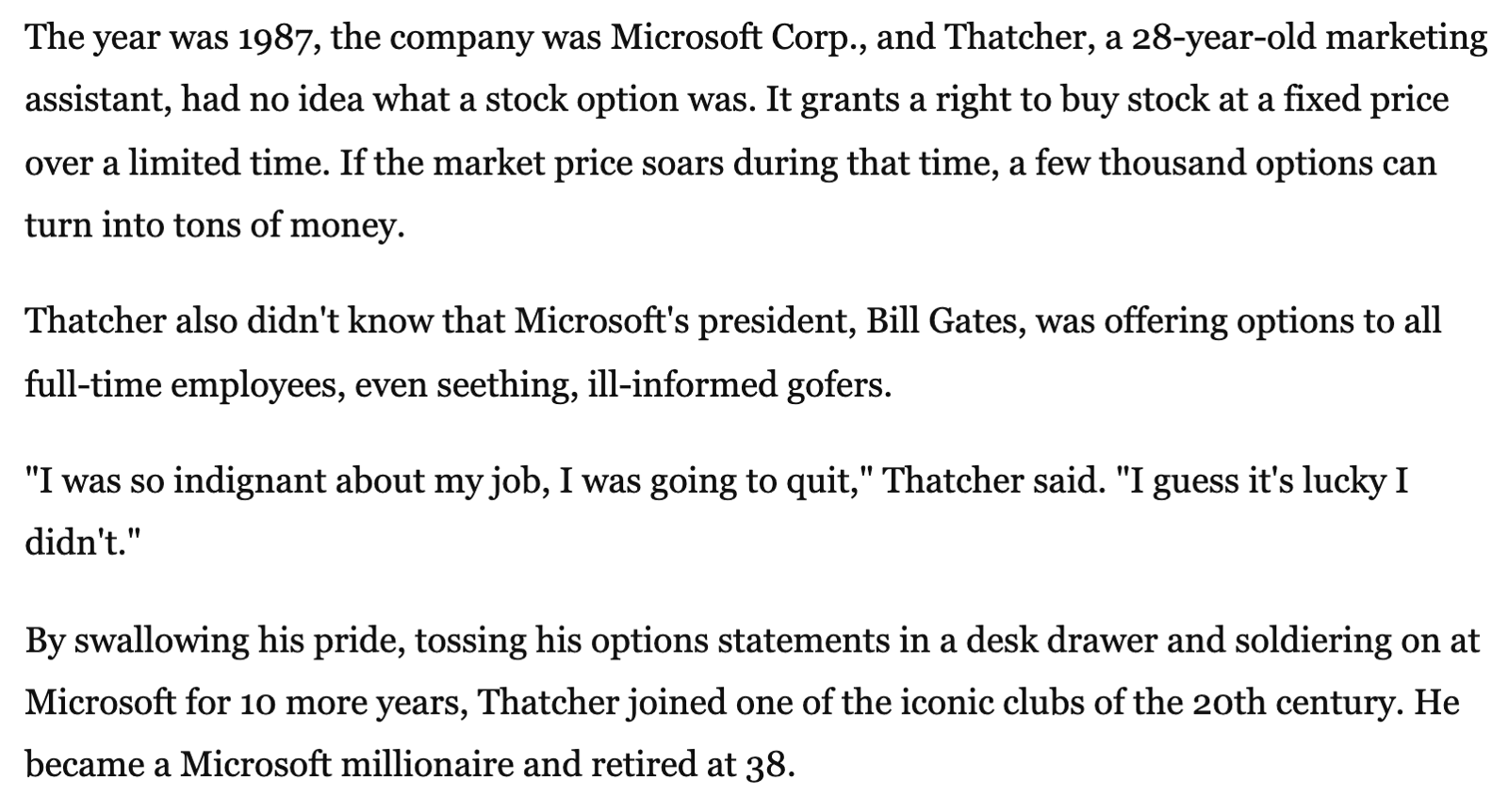

Meet Randall Thatcher, whose daily responsibilities back in the day look more like yours than those of David Choe, the graffiti artist. Although he may not have been gifted in the art of spray painting, Thatcher received stock options in the early days of Microsoft and retired as a millionaire.

Thatcher didn’t know Microsoft was gonna be Microsoft. Like many of us, he probably scrolling through the 1987 version of LinkedIn during workday thinking he could just be anywhere else but here. Did Thatcher have staunch faith in what was then a literal micro business to become the Microsoft we know of? Probably not. There were presumably many factors behind his decision, but Thatcher’s stock option agreement could have been one of them.

When you receive your offer letter, the letter won’t tell you a great deal about the stock options in your compensation package. However, you will have to sign the stock option agreement that details how your company will grant stock options. This is where you need to pay attention to. You will find out the exercise price, the kind and number of stock options you will receive, and how they will be vested.

You worked hard, sent too many emails, dealt with too many cold clients. And… your cliff finally passed while you didn’t realize. Congratulations! Your stock options are vested, and now you are finally able to exercise them. Also, although it may seem obvious, note that you can exercise your stock options once the current market price is greater than the exercise price.

If your company does super well and the current market price goes way beyond the exercise price, then yay! You will exercise your stock options, buy stocks at a low exercise price, sell them at a high market price, creating a bigger margin. You will have made a fortune.

Reversely, if your company does badly and the market price never reaches the strike price, you may never get to exercise your options. And sadly, yes this does happen in the startup world.

It is also important to consider when you will exercise your stock options. Depending on the strike price and the number of shares, exercising your options may cost $$$. Find out things to consider as you exercise your stock options in our next post.

References :

※ Legal Disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.